The fintech sector is booming in India. There are already over 6600 fintech companies in the country and the fintech market size is very well expected to grow up to $150 billion by 2025.

As per the financial report by the Indian Government, “Volume of UPI transactions increased 200x from January 2017 (4.5 Mn) to January 2023 (10 Bn), and the Value increased 600x during the same period.”

Such exceptional growth is only possible because the top fintech companies in India didn’t fail to deliver. They not only catered to the needs of the customers but have also rendered innovative fintech solutions that go beyond expectations.

This article talks about such innovative and reliable fintech services provided by the top-notch firms of India and how they are contributing to bringing forth such a digital revolution in the fintech sector.

1. Paytm

Almost everyone can agree that nowadays, Paytm currently holds the position of the top fintech company in India. Their digital payment service is so popular that the company name has itself become the identity of mobile payment. People here say “Paytm karo” (do Paytm) when they want to make a mobile payment. The fun fact here is that Paytm is kind of an abbreviation and its full form is Pay through mobile. Vijay Shekhar Sharma founded it in 2000.

Paytm offers payment, banking, insurance, and lending services to merchants and consumers. Online transactions for various purposes such as payments of mobile and utility bills, booking travel or movie tickets, in-store payments, and account-to-account transactions are possible through a mobile number, UPI ID, or a QR code, whatever seems convenient. In addition, small businesses can easily get loan disbursement services from Paytm.

USP: Paytm covered the fintech market in India with its digital payment services via e-wallets. Later when the Indian Government launched the Universal Payment Interface or UPI functionality, Paytm included it in their suite of services and became the digital payments services provider in India.

2. Lendingkart

An ex-ISRO scientist Mukul Sachan and an ex-banker Harshvardhan Lunia founded LendingKart in 2014 as a digital lending platform for small and medium-sized enterprises (SMEs).

The professionals here utilize machine learning algorithms and data analysis tools to assess the creditworthiness of a customer along with identifying risks, detecting frauds, and disbursing loans within 72 hours. Their data models handle the underwriting process.

Their ML training models also help with loan approval as well as the underwriting process. The company claims to have proprietary algorithms that can assess the creditworthiness of a customer over 7000 variables collected from multiple sources and stored across different apps, docs, and databases.

USP: LendingKart was one of the first fintech companies that leveraged AI and ML technologies to automate the underwriting process. Such a process would also allow people without any kind of credit scores, to qualify for the loans.

3. MoneyTap

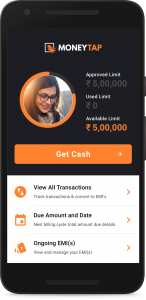

Anuj Kacker, Kunal Verma, and Bala Parthasarathy are the three entrepreneurs that founded the MoneyTap in 2015. Their mobile app does the entire KYC process and provides an instant loan of up to 5 lakh rupees. MoneyTap has also collaborated with banks to offer quick and flexible personal loans to individuals smoothly.

Not only is there no need for a bank visit, this entire process is completely paperless. Personal loans from MoneyTap can range from two months to as long as three years. It is also collateral free.

USP: People without any kind of credit score can also easily take loans from MoneyTap.

4. Instamojo

Instamojo was the first company to bring payment links to India. This has helped small businesses go online. Their simply integrable and easy-to-use payment solutions allow businesses to collect online payments.

Apart from online payment solutions, Instamojo also provides services that can help business owners build and run an online store. It also offers data analysis tools that keep track of the store’s performance and then provides useful information on how to grow the business.

Rendering meaningful connections, tools, services, and content ensures that the online store soon gets on the fast track of growth. Instamojo platform already has over 500,000 sellers on the platform.

USP: The company was the first to provide payment services through links. So, their payment collection process is more flexible.

5. Razorpay

Razorpay is considered to provide one of the safest, quickest, simple, and cost-effective ways to accept and disburse digital payments in India. This online payment solution gives a variety of choices for preferred modes of payment like UPI, net banking, credit and debit cards, and different types of e-wallets in India such as Airtel Money, Ola Money, Mobikwik, JioMoney, and more.

Razorpsay also comes with a comprehensive dashboard that allows users to manage their payments through mobile and web applications. The company has also introduced a variety of features in the last few years like Razorpay invoices, Razorpay Subscriptions, Razorpay Smart Collect, and Razorpay Route.

Apart from that, the company also manages a wide range of tasks such as collecting scheduled payments, bank wires, money disbursement, cash flows, and automating NEFT.

USP: For a business, Razorpay offers a complete payment solution ranging from collecting scheduled payments to generating invoices. It is not only hailed as one of the largest payment gateway solutions in India but the company is also working on providing neoBank services to their customers.

6. Shiksha Finance

Shiksha Finance gives loans to students for paying school fees and educational institutions for infrastructure development, working capital, and asset creation. So, you can say that the major products of this fintech platform in India are asset finance and study loans.

Furthermore, Shiksha Finance intends to open more schools in towns and villages to lower their dropout rates. The company also finances entrepreneurs that strive to make quality education easily accessible to the masses.

Shiksha Finance doesn’t hesitate to provide loans even if the customer has no kind of income. They can just provide their CIBIL scores or bank statements that can validate their financial standing to obtain the loan. So they are working to create a new psychometric-based business model that can evaluate the financial standing of such customers.

USP: The target market is very specific for Shiksha Finance. And they think of their work as their service to the community instead of thinking of it as a business.

7. Pine Labs

Pine Labs are considered the pioneers of the card-based payment and loyalty programs in the petroleum industry of India. But with the changing requirements of the merchants, the company reinvented its business model in 2012. And because of that, Pine Labs was able to pioneer a cloud-based, intelligent, and unified point-of-sale platform.

While contributing to the development of the digital economy in India as well as the world, Pine Labs has revolutionized the fintech industry. The company is currently laser-focused on the development of a product and services platform that can accelerate commerce, broadens access, and automate the local market merchants. And Pine Labs is powering more than three hundred and fifty thousand POS terminals in India alone.

USP: Pine Labs is not only one of the oldest fintech companies in India, it also pioneered a card-based payment system. Pine Labs is also one of the first ones to offer NFC-based payment solutions to merchants.

8. ZestMoney

Obtaining loans was made easy by ZestMoney as it combines digital banking with mobile technology and artificial intelligence. While most lending institutions are not eager to lend their money to someone who has zero credit history, ZestMoney does not see it as a barrier to getting a loan.

ZestMoney leverages its AI-based ML decision engine to create a risk profile for everyone who doesn’t have a credit score. Such people have to provide some additional information based on which ZestMoney’s decision engine will evaluate the credibility of the borrower.

USP: The underwriting process at ZestMoney is AI-enabled. The company is known to provide its clients with credit even if the banks won’t.

9. PolicyBazaar

Policybazaar is a leading insurance product aggregator in India. Initially, the company used to provide insurance-related information and compare policy prices when it was founded in 2008. In addition to being an insurance marketplace, PolicyBazaar also helps with claim settlement and policy cancellations/renewals.

USP: Comparing products and policies is now easy for small businesses, thanks to PolicyBazaar. Sometimes a customer feels stuck with the financial institution which more often happens to be a large traditional bank. But PolicyBazaar would let the customer in on all the options by democratizing the entire financial product landscape.

10. InCred

Being a non-bank financial institution, InCred offers home, educational, personal, and SME loan services. They enhanced their capabilities for analytics and risk management using technology. A major US-based asset manager is backing this company along with several others.

USP: InCred is willing to offer personal loans for cases where the banks might be reluctant to.

Conclusion

The invention of the internet was a boon because it contributed significantly to the rapid growth of the fintech industry. Portable banking, digital banking, web-based shopping, electronic payments, web-based business models, none of this world exists if the internet wasn’t around.

And now, the fintech companies are bringing the level of advancement to this which was very difficult to achieve even with the advent of the internet. And the fintech companies in India are not hesitating to dig through untapped areas outside the traditional finance services sector.

The economy of India relies heavily on the finance sector and it has benefited a lot with the growth of the fintech market. Some of the fintech services like digital payments are considered to be the stepping stones to these advancements. The insurance and loan lending sectors have also registered significant growth amidst the fintech revolution.