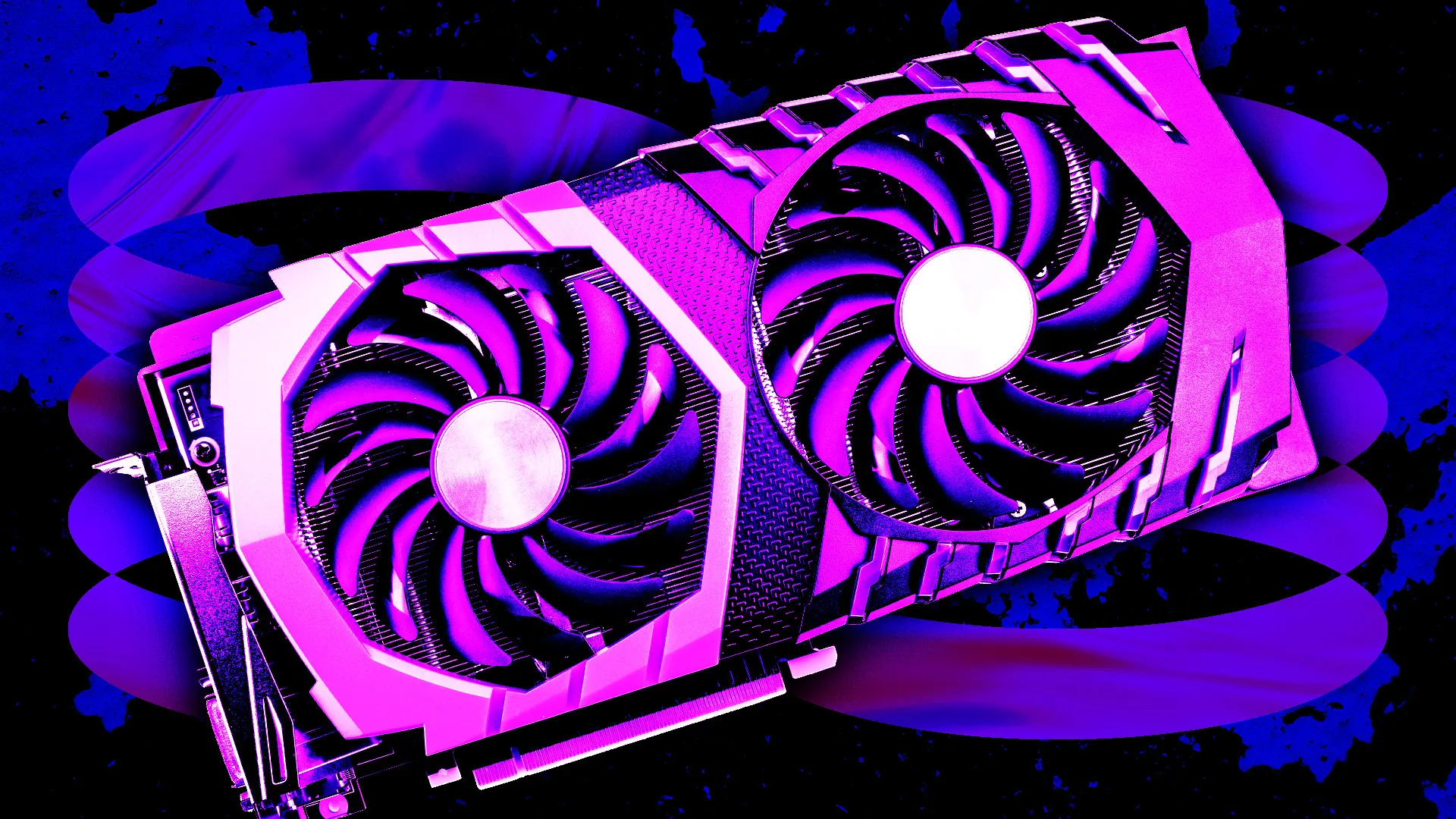

GPU mining involves validating transaction blocks using specialized graphic cards to solve complex mathematical puzzles. Using graphic cards, miners can swiftly divide and process tasks that require high energy and resources. However, the Ethereum network transitioned from a proof-of-work consensus mechanism to a proof-of-stake system. This transition will reduce energy consumption in the Ethereum network by 99% and phase out crypto mining on the Ethereum blockchain. This transition to the PoS mechanism has raised concerns about existing mining equipment.

Under the proof-of-stake model, several computers act as nodes to validate a single transaction block. Randomly selected validators create new blocks in the blockchain. In the long run, GPU equipment will be rendered useless, making Ethereum mining more economical compared to the pre-merge era.

GPU Mining After The Ethereum Merge

The Ethereum Merge forced many miners to shift to alternative mineable cryptos or sell their equipment. One of the effects of the Ethereum merge is that miners are shifting to mine the Ethereum fork or Ethereum Classic (ETC). The hash rate of the Ethereum fork increased after the Merge. The computational power needed to approve a transaction is known as a hash rate.

Miners are finding it hard to earn past revenue figures. Miners are earning less with stablecoin chains or other proof-of-work blockchains. High hash rates for alternative GPU-mineable crypto coins are also making mining difficult. Hive Blockchain says that miners with efficient equipment might succeed in the long run. Miners might sell their GPU equipment if the difficulty of mine on alternative chains keeps increasing.

Read more: What is Crypto

Miners Might Change Their Business Model

Miners have gained interest in Defi staking because of the high rewards. Miners might have to shift to high-performance computing. GPU miners can pool their resources together to benefit from Web3 protocols like Render and Livepeer. Additionally, GPU miners can explore other emerging technologies like cloud computing and artificial intelligence.

What to Mine After The Ethereum Merge?

- Aeternity

Aeternity has been around for some time and uses the CuckooCycle algorithm. This crypto coin targets application resembling the Ethereum network. Aeternity can be mined using both AMD and Nvidia GPUs.

- Raven coin

Raven Coin (RVN) was created in 2018 and is the first crypto to use the KAWPOW algorithm. The Raven coin is mined by thousands of miners. It is also supported by many crypto exchanges and pools. This crypto coin is bound to get even more popular. RVN can be mined using both AMD and Nvidia GPUs. It can be mined with miners like gminer, teamredminer, and nbminer.

- Ethereum Classic

Many miners have jumped onto Ethereum Classic (ETC) after the Merge. Ethereum Classic has become a popular crypto coin to mine since the Merge. ETC can be mined with many miners, such as gminer, nbminer, teamredminer, and others. It can be mined using both AMD and Nvidia processing units. Users will find it easy to get started with this crypto coin as it is supported by many exchanges and pools.

- Neoxa

According to its developers, Neoxa is a decentralized blockchain for developers, gamers, and miners. Neoxa is a new gaming-related crypto coin. Neoxa also uses the KAWPOW algorithm. It can be mined using Nvidia and AMD GPUs with miners such as nbminer, gminer, and teamredminer.

The Future of GPU Mining

The future of GPU mining depends on the willingness of miners to mine alternative cryptos. As long as the energy costs for GPU miners are low, mining may continue to thrive. Moreover, there are other applications for graphic processing units, such as gaming, video editing, and graphic design.

GPU miners can use their equipment to mine other cryptos when a blockchain protocol migrates to alternative consensus algorithms. This feature enables GPU miners to continue mining during events like the Merge, unlike application-specific integrated circuit (ASIC) miners. ASICs cannot be modified to mine other alternative cryptos.

Read more: How To Build A Crypto Mining Rig

ASICs offer a higher hash rate and are more energy-efficient. These features incentivize miners to switch to application-specific integrated circuit equipment. However, the high cost of ASIC mining equipment makes it unappealing to solo miners.

A miner should only invest in equipment that supports the blockchain on which they will be mining cryptos. Miners should also take into consideration several factors such as hash rate, block reward, and crypto price before investing in heavy mining equipment.

You can now buy ETH through ZebPay. Get started with crypto trading on the go with Zebpay.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Each investor must do his/her own research or seek independent advice if necessary before initiating any transactions in crypto products and NFTs. The views, thoughts, and opinions expressed in the article belong solely to the author, and not to ZebPay or the author’s employer or other groups or individuals. ZebPay shall not be held liable for any acts or omissions, or losses incurred by the investors. ZebPay has not received any compensation in cash or kind for the above article and the article is provided “as is”, with no guarantee of completeness, accuracy, timeliness or of the results obtained from the use of this information.