“What is this new promotion about ‘Blue Gas’? Why are individuals so worried about it? Prior to hopping into the suspicions rotating around blue gas being the Tesla Executioner Stock, how about we sort it out, what’s this ‘Blue Gas‘? Blue gas isn’t anything extraordinary, however a hydrocarbon fuel, which is efficiently manufactured from hydrogen and carbon feedstocks. It is like gas or diesel however a greater amount of a raw express, or at least, not being decontaminated from petrol.”

The specialty of Blue Gas

It appears glaringly evident to view Blue Gas as a comparable to fuel or diesel, however there is something else to it besides grabs the attention and the justification behind such gigantic promotion about it. At its center, Blue Gas is hydrogen yet not the same as the dim hydrogen that has been in need for over 100 years. Throughout the long term, mechanical improvement empowered hydrogen creation to scale, and its fascination developed as a sans carbon energy transporter. Besides, hydrogen’s true capacity as a stockpiling asset has expanded its fascination. Capacity permits clients to release the maximum capacity of hydrogen for complete decarbonization of the energy framework and produce low carbon Blue fuel gas, also known as Blue Gas.

Why the commotion about Blue Gas being a Tesla Executioner

The customary car industry is confronting an existential emergency despite the developing ubiquity of Electric Vehicles (EVs) drove by Tesla and a few other worldwide EV organizations that are sloping up creation while cutting down the cost of electric vehicles. In the midst of the continuous discussion about the suitability of EVs, the auto business is vigorously putting money on involving Blue Gas in Inner Ignition (IC) motors to guarantee low fossil fuel byproducts that can assist the business with countering the danger presented by the quickly developing EV industry. Numerous specialists even accept that the progress of Blue Gas could ring the mark of the end of Tesla, which is making colossal publicity about the supposed eco-accommodating fuel.

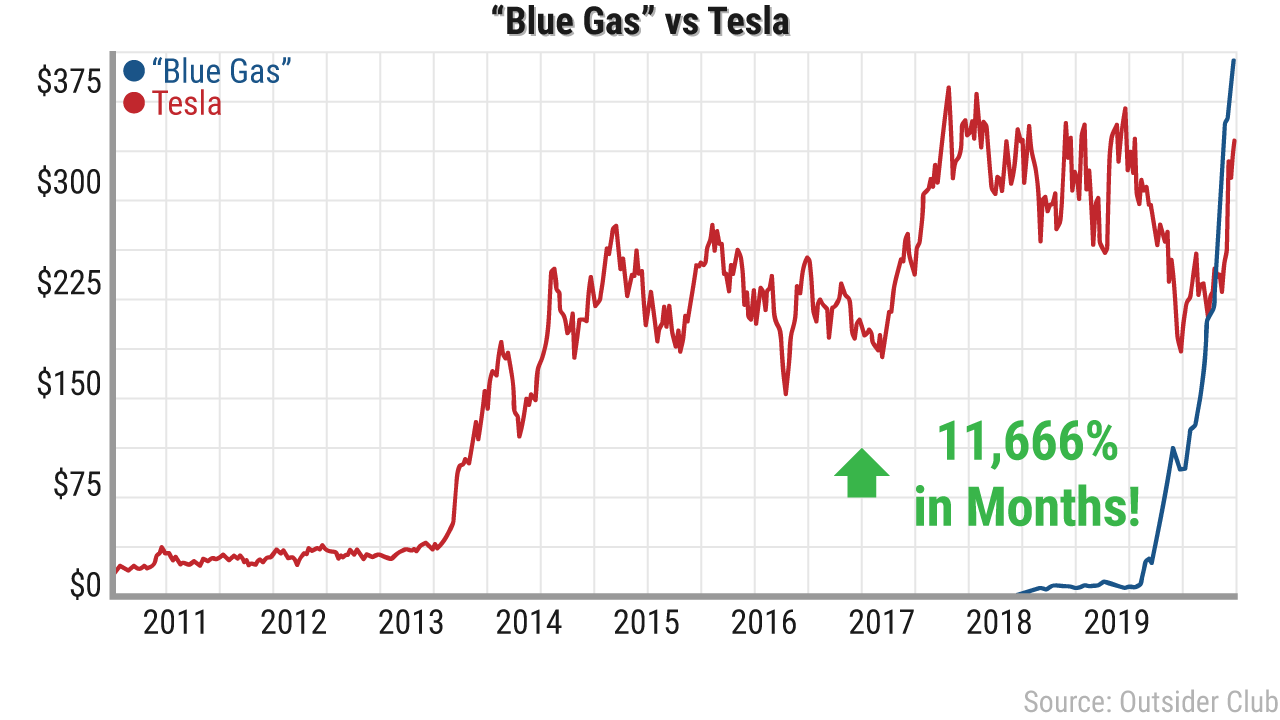

Tesla Executioner stock has been unveiled. An exceptionally unstable stock opened up in China and afterward went ton to catch the worldwide market by coming to NSE. The cost of the blue gas stock shot up by very nearly 6,000 percent somewhat recently making a gigantic air pocket in the financial exchange. It plunged to a gigantic degree and presently the blue gas stock has been confronting a typical fall of twelve percent for the beyond 90 days. This has made the stock inclined to fast changes because of market variances.

About Blue Gas Stocks

Linde is one of the greatest market providers of hydrogen gas and oxygen-based fuel among other market holders. We ought to look out for it since it could come into utilization on the off chance that energy component reception can get a move on or on the other hand in the event that Space X send-offs those trips in the numbers they have been discussing. Pretty much every power module is provided through privately owned businesses and is costly. Right now there are a couple of blue gas stocks. We haven’t found a supplier for blue gas that has soil with SpaceX. Tesla stocks have been fueled by these basic blue gas stocks and therefore, their costs shot up generally in under a month.

Tesla’s blue gas vehicles have become problematic to the securities exchange. A long time back, Tesla stocks were doing fine and dandy This was the point at which the stock made a huge air pocket. Individuals’ assumptions about blue gas stocks were consequently at a look. As furious purchasers attempted to purchase increasingly more of these stocks, the air pocket in light of blue gas organizations and their stocks turned out to be adequately large to rush soon.

Blue gas innovation stock is drawing in financial backers

The promotion encompassing Blue Gas has is making waves in the securities exchange, apparent from the rising revenue among financial backers in blue gas innovation stock. Flammable gas organizations are in the focal point of financial backers since it is a wellspring of Blue Gas. Makers of Blue Gas utilize the steam methane transforming process by blending petroleum gas and exceptionally hot steam and an impetus. To purchase blue fuel stock, you should zero in on the petroleum gas organizations that produce low carbon energizes that hold great commitment for cleaner fills to overcome any issues while traveling to bring down carbon choices. The extraordinary attributes of flammable gas highlight its developing interest before very long in light of the fact that it is modest and plentifully accessible other than being the cleanest fuel.

Here are a few top petroleum gas stocks that are passages to blue gas organizations to put resources into. The organizations referenced here have an interest in flammable gas and related items, particularly hydrogen.

Plug Power

A trailblazer in the hydrogen energy component industry, Fitting Power stock is alluring to financial backers excited about purchasing blue fuel stock. The organization was first to make a business opportunity for hydrogen power device innovation that turned out to be economically reasonable. The organization has an introduced limit of 50,000 power device frameworks which is the greatest in the business. Vehicles and armadas that utilization electric powertrain advances utilize the items. The organization works a main hydrogen age network in North America and is one of the biggest worldwide purchasers of hydrogen.

The organization is setting up a few hydrogen establishes that are under development and expected to begin creation in 2022. Plug Power has plans to set up more hydrogen plants before very long. As hydrogen is the fuel of tomorrow, financial backers who need to put resources into American created blue gas can pick Power Attachment as the organization needs to fabricate the world’s most memorable green hydrogen biological system. Financial backers can wager huge on the organization that needs to possess the top stop as the class chief on the lookout.

Air Items

One of the biggest providers of modern gases around the world, Air Items is a worldwide forerunner in LNG handling innovation and hardware. A forerunner in hydrogen fuel foundation, Air Items is one of the biggest providers of business hydrogen.

The organization tries to turn into a main worldwide arrangement supplier for the different energy and ecological difficulties that the world is as of now looking by providing clean hydrogen and through carbon catch and gasification. Various continuous significant hydrogen projects are probably going to be finished in the following couple of years. It remembers the blue hydrogen task of $4.5 billion for Louisiana, a joint-adventure undertaking of $7 billion in Saudi Arabia for creating sans carbon hydrogen, and a $1 billion venture in Canada for net-zero hydrogen that ought to become useful inside 2024 and 2026. On fruition of the ventures, Air Items could find its place at the top as a worldwide hydrogen energy organization.

Air Items stock is an honest to goodness hydrogen stock that holds a great deal of commitments for financial backers.

Sprout Energy

Sprout’s Energy will likely create spotless and dependable energy at a reasonable cost. Financial backers would find Sprout Energy one of the picked blue gas organizations to put resources into. Prior, the organization fostered an on location electric power age stage, the Sprout Energy Server, and in 2021 presented the Blossom Electrolyzer that involves a similar strong oxide innovation as the Blossom Energy Server for delivering clean hydrogen all the more productively. The innovation would assist with further developing assembling effectiveness by 15% to 45% contrasted with different items available.

The Blossom Electrolyzer, which is scheduled for delivery in the fall of 2022, will be an extraordinary jump forward in hydrogen creation. The innovation will be a significant improvement for decarbonization in weighty businesses like synthetics, steel, glass, and concrete assembling.

Fuel Energy Cell

Fuel Energy Cell involves its exclusive power module innovation for creating hydrogen, and clients of its SureSource items can produce super clean power nearby. The innovation is valuable for delivering spotless and reasonable electrical energy for assembling offices, wastewater treatment plants, colleges, and emergency clinics.

Proposing to turn into a forerunner in decarbonization processes, the organization is dealing with different ventures like catching carbon and other nursery gasses throughout delivering power, creating low carbon as well as sans carbon power and providing blue and green hydrogen power. The organization additionally has plans of putting away energy created by switching discontinuous environmentally friendly power over completely to hydrogen and, if necessary, can change over it back to power.

Fuel Energy Cell stock is an unquestionable necessity for their portfolios for blue gas innovation stock financial backers

Stocks For Electric Vehicle Innovation

In 2021, each huge vehicle organization is putting resources into stocks that have Electric vehicle innovation partner with them. Creation qualities previously had an additional advantage as introduced showroom and fix networks were pair with their presence in the customer’s psyches and portfolios.

We should accept a model. Volkswagen has contributed around US$ 91 Billion US dollars. This is two times TESLA’s normal deals for 2021. Their new reach comprising of better and further developed electric vehicles has made their presence felt. This thus caused them to enter the EV market and it is presently developing exceptionally quick.

What is the blue gas stock air pocket? How could it be made?

We realize that Tesla was selling vehicles eon masse. It was making right around fourteen hundred deals in Norway alone. This expanded the interest for blue gas organizations to sell more blue gas, expanding the future cost of their stocks. Nonetheless, in 2020, tesla vehicles could sell on 3,000 vehicles though Volkswagen sold in excess of 20,000 vehicles. Thus, Volkswagen had made a decent and observable section into the electric vehicle market.

This was not the end. Hyundai and Nissan performed better compared to Tesla in 2020 and sold in larger numbers, catching a more noteworthy market space. The market that had once made a few air pockets, raising the costs of blue gas stocks was currently plunging to a record-breaking low. In 2021, we have perceived how eccentric the securities exchange can really get. Tesla is missing out on faithful as well as forthcoming purchasers to more seasoned and more acknowledged organizations. These organizations have known for a very long time how to catch the working class market and the worldwide market with efficiency.

Tesla Stock Cost

In the US, the cost of the TESLA stock fell underneath the assumption for the market. This gave confirmation that TESLA had missed out on its most dependable market in the US. This was a center buyer base for TESLA. Subsequently, this prepared for Tesla Executioner stock.

TESLA stocks and the hidden blue gas stocks subsequently tumbled to an untouched low valuation bringing about the explosion of the air pocket. In China the year 2020 saw the expansions in EV deals to a gigantic expand. TESLA couldn’t conceal for this part of the market too. This is a direct result of the extreme costs of the TESLA vehicles. General Engines caught the greatest offer and left the piece of the pie of TESLA wrecked.

How can Tesla lose its worth?

What the information needs to show is that TESLA is quickly missing out on strong ground quick. In the now blasting and advancing Electric Vehicle market better and more experienced players are concocting their methodologies and changing to EVs. This while profiting from their image values. With this is added a huge and enhanced showroom organization and long periods of consumer loyalty.

Assuming you are putting resources into TESLA and purchasing out blue gas stocks since you are convinced, possibly by mistake, that Elon Musk is virtuoso or in light of the fact that you have been enamored with the presentation of the fundamental stock in the subsidiaries or essential market then, at that point, kindly think about reconsidering. A slip look into the eventual fate of the business never hurt anybody.

Executioner stocks and how might they show up?

The Tesla executioner stock is a consequence of the falling costs of their stocks. Other than the straightforward truth that the much discussed innovation of TESLA Battery depends on particle lithium which is soon to become outdated when the rise of quantum glass and related advancements foster all the more quickly by Samsung and other such organizations like Panasonic and Quantum Space. The real TESLA executioner stock is accompanying the decrease in profit. This is an unquestionable necessity as little Ballard Power Frameworks (BLDP isn’t a $3 stock). Its cost has multiplied throughout recent months. Geoffrey Ballard is viewed as the dad of the power module and thus the temporary dad of the blue gas stock.

Geoffrey Ballard was not any more working with the dynamic administration at Ballard Power and he had been working with the organization for about quite a while back. As a matter of fact, it was shaped by one more organization that had been thusly offered to a greater organization called Fitting Power. One more frequently pursued energy component organization has arisen on the lookout and it has been giving severe rivalry to Ballard Power.

Weichai powers have taken up an impressive piece of the pie in China and have been selling blue gas stocks for EV markets.

Blue Gas Stock Costs

All the power cell organization costs have gone up to a significant degree. In specific months however, the financial exchange holders need to keep an eye out for the period of January when blue gas stock costs for the most part fall.

Indeed, frankly, the most justifiable thing you should note will be taken to after a brief glance at the financials of the organization. Ballard stock and the resulting blue gas stock is exchanging fervently as an insane cloud-like stock. The product stock is at a valuation of $2 billion. It has been exchanging at in excess of multiple times the cost of required deals. Notwithstanding, it is presently not even close to productivity. The deals are supposed to develop at around 35-40% every year and month to month development will likewise be followed by the greater organizations. As they sell fuel stocks in light of blue gas or hydrogen gas go into the transports/trucks adventure of China, the availability of the stock will be broad.

End

The instability of such business sectors is complex. In this way, the financial backers should pay special attention to the fall of TESLA Executioner stocks. This will make hydrogen or blue gas stock costs fall.