The quickest and easiest manner to become aware of bills showing unpaid errors in QuickBooks is from an assessment of the accounts Payable getting old precise documents. The accounts Payable growing old precis report affords a quick photograph of the exceptional invoice as of a particular date. Most of the wonderful payments have to be incredibly modern-day. An elderly bill inside the >ninety days may additionally indicate an error or a transaction that calls for an adjustment.

Mistakes

- The customer enters bills after which writes assessments

- There are unapplied supplier credit

Signs

- Accounts Payable stability is high with many aged bills

- Fees seem unreasonably high

- The financial institution account stability seems correct

- Numerous unapplied seller credit

Consistently old wonderful payments can also indicate profitability or coins go with the flow issue. A seller that looks at the file and has a 0 balance inside the general column indicates that all transactions have no longer been “related” or credit have not been implemented well.

Excessive amounts inside the >90 days column is a sign of both an information access issue or a larger problem that would require the involvement of the management of the enterprise.

Repair Unapplied supplier bills and credits

In patron records evaluation, the restoration Unapplied dealer payments and credits device corrects money owed payable posting issues. This option works similar to the Unapplied customer payments to Invoices. Here, exams are written to companies as opposed to invoice payments getting used. Therefore, payments are nonetheless shown as remarkable even though tests written to the seller or exquisite dealer credit are available but have not been carried out to the invoice. Tests and dealer credits are implemented to bills within the identical fashion as client payments were implemented to invoices as described within the bills Receivable phase of this record.

Take a look at Written rather than Pay bills

Bills receivable issues often arise when customers first use enter bills to document an amount due but then use Write exams in place of Pay payments to pay those payments. Typically, the patron would report the take a look at to the equal expense account used while the bill became recorded ensuing in prices being doubled. The Accounts Payable account would also be overstated and comprise numerous antique, unpaid payments which had in truth been paid.

Messaging has been progressed in the brand new versions of QuickBooks, encouraging customers to go to Pay bills, however, this error may additionally still occur. Two objects to recall earlier than figuring out the way to correct the hassle are, first whether the consumer is at the coins or accrual basis of accounting and 2d whether or no longer the financial institution account has been reconciled.

Accrual foundation – No bank Reconciliation

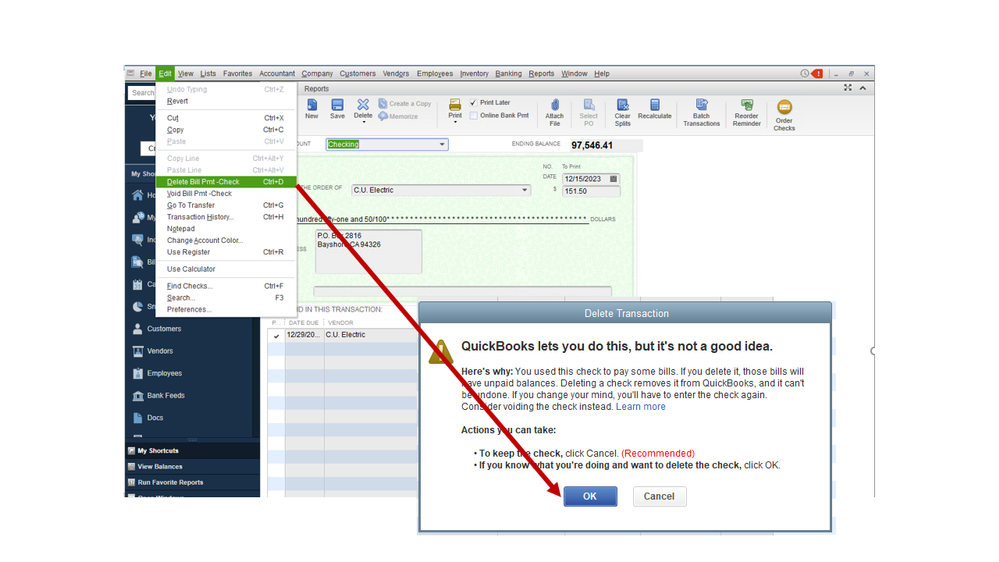

If the purchaser uses the accrual basis of accounting and the financial institution reconciliation has not been completed, the incorrectly entered exams may be genuinely deleted and the checks re-entered the usage of the Pay payments function. Deleting transactions quickly is easy using the CTRL-D shortcut. Backing up the statistics file earlier than making significant adjustments is always encouraged. Additionally, a check sign-up has to be published, or take a look at copies must be available to enable the rerecording of the assessments. The exams have to first be reentered using the invoice Pay features, then the checks appearing as a duplicate, no longer written as an invoice fee can be deleted. Reentering the bills first will maintain the unique enter records if it’s far wanted whilst getting into the bill payments.

Accrual foundation – financial institution Reconciliation completed

For customers who use the accrual foundation of accounting, the dates recorded on bills and invoice payments are important for correct reporting. If a charge to a supplier has already been entered as a take a look at, not a bill charge test, and the bank reconciliation has been finished, deleting the test as defined above will require redoing all of the bank reconciliations as a way back as transactions are affected. This may be a totally time-ingesting and tedious system. For this reason, the pleasant solution is to change the account code on the check to accounts Payable, ensuring that within the column entitled client: job the seller name is entered. A credit score is created which can then be linked and offset to the bill that became created.

Step 1 – accurate Coding of test

- Within the dealer center, find the check that has entered incorrectly and edit the test changing the account to debts Payable and inclusive of the vendor call within the purchaser: process area as illustrated underneath.

- Document the alternate. Entire this equal manner for all tests that must be linked to an invoice.

Step 2 – link check to bill

Next, go into Pay bills and select the precise bill to pay, and click on Set credit as shown underneath.

Conclusion

In the reductions & credits display screen, select an appropriate credit score, to be able to be the check that turned into just edited, to be implemented to the invoice. (note that the test quantity is inside the reference subject). The credit score might be carried out to the invoice and the quantity to Pay will then be 0. The transactions are then connected together.