Introduction

Financial issues can put a strain on any relationship, and the story of “Ichaichai Suru to Okane Ga Waichau Futari No Hanashi” explores the challenges faced by a couple as they navigate their financial ups and downs. In this article, we will delve into the story, its implications, and the lessons we can learn from it. Join us as we explore the complexities of love, money, and the impact they have on our lives.

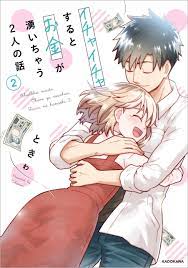

Understanding “Ichaichai Suru to Okane Ga Waichau Futari No Hanashi”

“Ichaichai Suru to Okane Ga Waichau Futari No Hanashi” is a phrase that translates to “If we spend money, our money will disappear,” capturing the essence of a couple’s struggle with financial stability. It is a popular Japanese saying that highlights the consequences of excessive spending and the potential strain it can put on a relationship.

The Story Unveiled

Our story begins with a couple, Ichai and Chai, who have recently started living together. Initially, their financial situation is stable, and they enjoy a comfortable life. However, as time passes, they encounter financial difficulties that lead to arguments and disagreements about money management.

The Downward Spiral

As the couple’s financial situation worsens, tensions rise. Ichai loses his job, leaving him without a steady source of income. Chai, on the other hand, is working part-time jobs to make ends meet. Despite their efforts, they find themselves falling behind on bills and struggling to cover their expenses.

The Breaking Point

Frustrated and overwhelmed, Ichai and Chai reach a breaking point. They realize that their financial struggles are taking a toll on their relationship and decide to separate temporarily, moving back in with their respective parents to alleviate financial burdens.

Reevaluating Priorities

During their time apart, Ichai and Chai reflect on their relationship and their financial choices. They come to understand that their dream of living independently was clouded by their financial struggles. This realization prompts them to reevaluate their priorities and make changes to regain stability.

Reconciliation and Growth

After some time apart, Ichai and Chai reconcile and decide to give their relationship another chance. They approach their financial situation with a newfound understanding and determination to overcome their challenges. Together, they create a plan to manage their expenses, save money, and work towards a debt-free future.

The Importance of Communication

One of the crucial lessons we can learn from this story is the significance of open and honest communication about finances in a relationship. Money-related issues often lead to stress and conflict, but discussing financial goals, responsibilities, and challenges can help couples navigate these difficulties together.

Avoiding Financial Struggles

To avoid finding themselves in a similar situation, couples can take proactive steps to manage their finances effectively. This includes creating a budget, tracking expenses, saving for emergencies, and discussing financial decisions together. Mutual understanding and transparency are key to maintaining financial stability in a relationship.

Seeking Professional Help

Sometimes, the complexities of financial struggles require professional guidance. Couples facing significant financial challenges can consider seeking the assistance of financial advisors or marriage counselors who specialize in helping couples navigate financial issues. These professionals can provide valuable insights and strategies tailored to the couple’s specific situation.

Conclusion

The story of “Ichaichai Suru to Okane Ga Waichau Futari No Hanashi” serves as a reminder of the impact financial struggles can have on relationships. It emphasizes the importance of open communication, understanding, and joint decision-making when it comes to managing money as a couple. By learning from the experiences of Ichai and Chai, we can strive to build stronger, more resilient relationships while maintaining financial stability. Remember, love and money can coexist harmoniously with effective communication and shared financial goals.