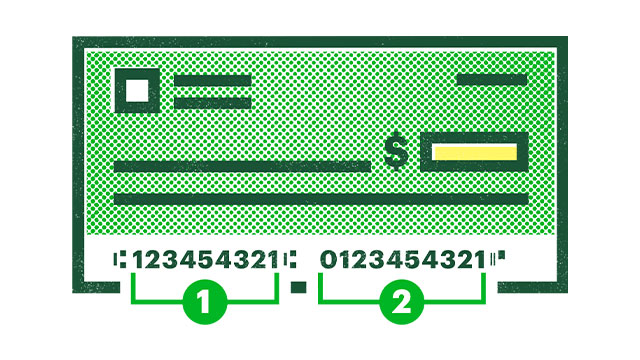

When you open a bank account with the Bank, you’ll notice that your check has two numbers. This number is unique to your checking account and personal account. The TD Bank Routing Number is known as a routing code and is unique for your Bank. This number must be print on checks for all checking accounts, whether personal or business.

What are the Numbers used for?

You may find a branch with thousands of customers or a small number of accounts. The financial clearinghouse uses the bank routing number to identify which bank system you are using and which branch you are with.

Each bank branch is assign a unique routing number. A small portion of this number identifies the Bank, but the remainder highlights which branch you opened your bank account. This is done to speed up the processing of your checks. The numbers are print using a format that allows computers to scan them.

The Internet boom and the emergence of the cyber age have allowed for new possibilities that would not have been possible twenty years ago. The Internet is a virtual world that has opened new possibilities for businesses, libraries, auction houses, and galleries. Online shopping is the best way to buy, sell or trade anything. It takes just a few clicks to travel the globe.

Checking Account and Routing Numbers Online

Internet trends have led to an entirely new trend: online banking. Online banking is the most exciting thing that has happened to the financial sector since the invention of coins. Many people find online banking just as confusing as the concept of coins was to them a thousand years ago. You can imagine this: a virtual bank filled with virtual cash, sent electronically via bits and bytes of data. You can access the Internet to borrow, lend, withdraw, and deposit money. Only this Bank exists online.

The first thing that comes to mind is, “Where’s the money? Although an online bank exists only in cyberspace, the two grand that you deposit into it is something you can hold. What is the best way to do online banking in cyberspace or the real world?

Finding Routing Numbers

Online banking of any type works in the same manner as credit cards. Even credit cards can be confusing. The credit card transmits information to a computer system. Information such as your account numbers and TD Bank Routing Number are keep on file by the Bank to track your account. One computer informs the Bank that you have charged two hundred dollars to your credit cards. This information is send over cyberspace via encrypt, secure transmissions. The data can be electronically remove from your account to replace it in another. Your balance changes to reflect this purchase. And theirs changes accordingly.

It is not possible to exchange money, and no one can hold that cash in their hand. Banks in brick-and-mortar do not keep that much money in vaults. Banks have cash available to lend to customers who make withdrawals. Most money moves from one account to the next.

Online banking doesn’t offer the same services as offline banking, such as a cashier’s cheque or notary. Online banking is convenient and offers many benefits that most people need to utilize more. If your landlord insists you pay your first month’s rent with cashier’s checks, inquire if they accept debit cards. You can easily call your local car dealership or title company to have a document notarized. For those who are more connected, online banking can provide a lot of conveniences. Traditional banks are better suit if you have to deal with much paper. Remember that you can always change the electronic financial system whenever you are comfortable.