Now that you have received your Citibank credit card or Citibank debit card, you must be thinking of using it at shops or while shopping online. But the instructions also say that a new Citibank card must be activated properly, only after that, Citibank customers can use it wherever they want. Even if you are an old customer at the bank and you have gotten yourself a new Citibank credit card then you must have to activate the card at CardActivation Citi Com. So, in order to help you to ease this process, we are going to tell you how to activate a new Citibank card @ cardactivation.citi.com.

Before jumping into the process of activating the Citibank card, you need to know the various ways to do this process so, you can decide which method is perfect for you.

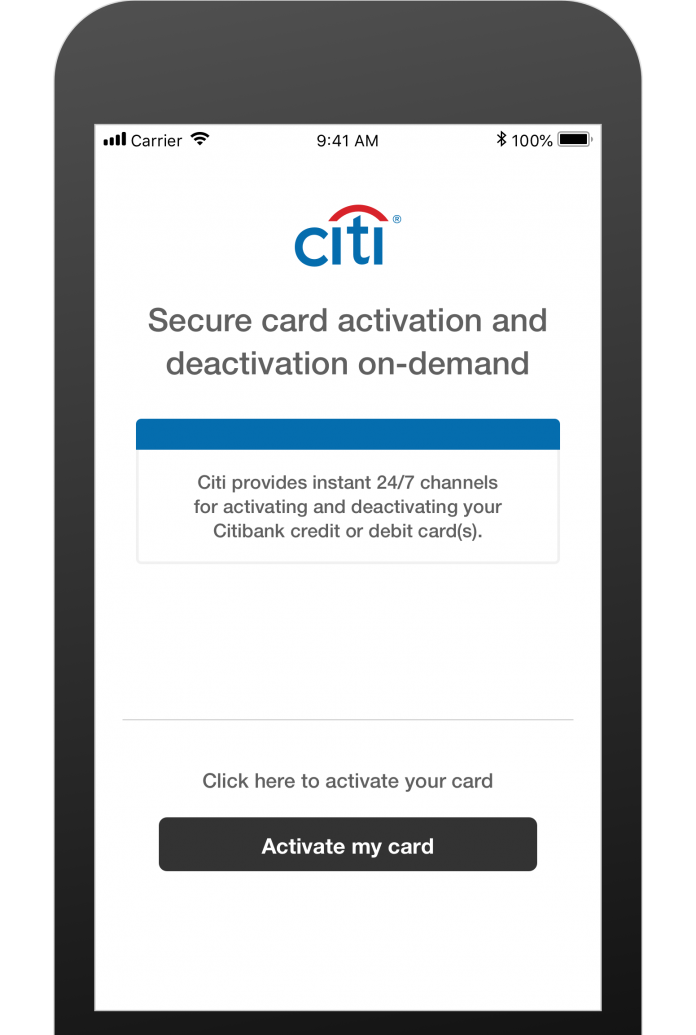

Online banking, Citibank mobile app, and calling Citibank customer care – these are three methods to activate and confirm your new Citibank credit card. Customers can go for any method and we shall describe every method in the article below.

Requirements to Activate Your Citibank Debit or Credit Card

A user should have generated a card pin through the Citibank ATM. If you don’t know how to generate from the ATM then you can simply follow the guide below to do it directly from the website. A customer also needs to register at the online banking website of Citibank.

Generate New ATM Pin for Citibank Cards

- Visit the Citibank internet banking website and register for the new account if you are a new customer or simply sign in if you are an old user.

- Select the option from a Credit card or Debit card in the “Account” section.

- Authorize your account identity by providing OTP through mobile number.

- Next, create a User ID and create IPIN that will be used to use to log in to Citibank mobile app and Citibank online banking site as well.

- Lastly, got to the option of ATM PIN to create a new PIN. A user can also generate and change the PIN directly by visiting Citibank ATM.

Once you have changed or created the new ATM PIN for your Citibank card, you would be able to sign in on the online portal with the user ID for the activation of Citibank credit card.

CardActivation.Citi.Com: Activate Citibank Card via Internet Banking

Simply follow the instructions given below to activate Citibank Debit or Credit card through online banking:

- Visit the online banking website of Citibank on your mobile or PC.

- Fill required details such as User ID and PIN or password that you created to login to the portal.

- Next, tap on the “Activate your Card” option mentioned on the site.

- A user needs to fill the details such as the credit/debit card number and expiry date.

- Once it’s done, tap on the continue and provide the ATM pin and then click on submit.

- An OTP will be received on the registered mobile number to authorize the changes and identity. Once it’s done, press continue.

Once all done correctly, a new Citibank Credit/Debit card will be activated

CardActivation.Citi.Com: Activate Citibank Card via Citibank Mobile App

Simply follow the instructions given below to activate Citibank Debit or Credit card through Citibank App:

- Download and install the Citibank mobile app on your iOS or Android device

- Now open the app on your smartphone and login with the user ID and the PIN or password.

- Tap on Activate your card option and then choose one option from debit or credit.

- The app will open the camera to click the photo of the card. Once you have clicked the photo, it will extract the detail mentioned on the card.

- Go to the next option and you have to enter your mPIN or OTP to authorize newly changed and confirm your identity.

- Once all done correctly, a new Citibank Credit/Debit card will be activated

CardActivation.Citi.Com: Activate Citibank Card via Customer Service

If these aforementioned options seem a little complicated for you then users also have a third option to activate his/her new Citibank credit card via calling customer care. The toll-free number is 1860-210-2484.

The process of this method could be varied for every user but the first requirement is to call this number from the cell phone number registered with the bank. Follow the guideline of the IVR and select the proper option. You need to provide necessary personal details to make sure you are the real user and then your card will be activated from the system automatically once the customer care executive triggers activation process.