The US Dollar Index (DXY) is a benchmark index that measures the performance of the US dollar against a basket of foreign currencies. It is one of the most important currency indexes in the world, as it serves as an indicator of global trade, investment and other economic activity. But what exactly does the DXY index do, and how can you use it to your advantage when trading? In this blog post, we will explore all the aspects of this index and how you can use it to spot trends and make profitable trades. Read on to learn more about what the DXY index is and how you can use it for your trading strategies.

What is the US Dollar Index?

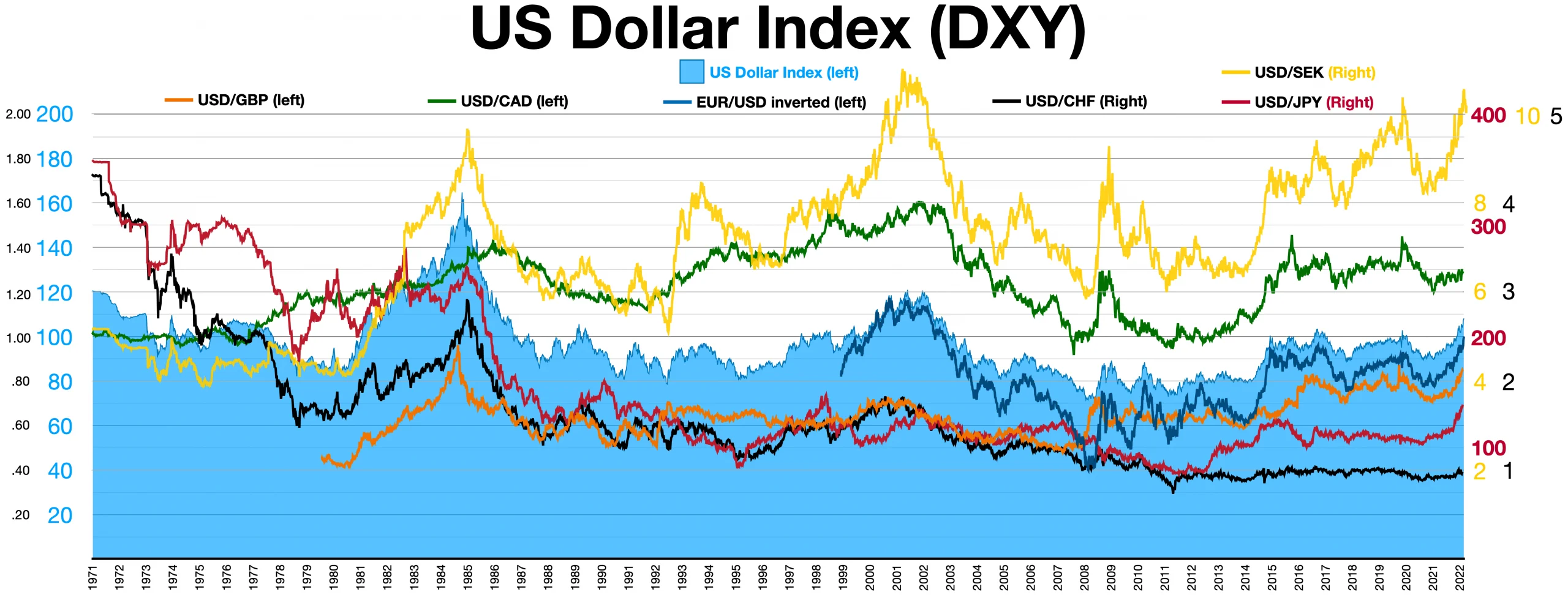

The US Dollar Index (DXY) is a measure of the value of the US dollar relative to a basket of six major currencies. The index is calculated by weighting the exchange rates of the six currencies against the US dollar. The weights are:

Euro (EUR): 57.6%

Japanese Yen (JPY): 13.6%

Pound Sterling (GBP): 11.9%

Canadian Dollar (CAD): 9.1%

Swiss Franc (CHF): 3.6%

Australian Dollar (AUD): 2.8%

The US Dollar Index is widely used as a measure of the strength of the US dollar and is often used by currency traders to speculate on the direction of the US dollar.

How is the US Dollar Index calculated?

The US Dollar Index (DXY) is a measure of the value of the United States dollar relative to a basket of six foreign currencies. The index is calculated by taking the weighted average of the exchange rates of the six currencies. The weighting is based on the economic importance of each currency in terms of trade and investment.

The US Dollar Index was created in 1973 and is currently calculated by Bloomberg L.P. It is published daily by the Federal Reserve Bank of New York. The index covers a wide range of time frames, from one day to five years.

The US Dollar Index is used by traders and investors to gauge the strength of the US dollar against other major currencies. It is also used as a benchmark for other financial instruments, such as bonds and commodities.

What factors influence the US Dollar Index?

What Factors Influence The US Dollar Index?

The US Dollar Index is a measure of the value of the United States dollar relative to a basket of foreign currencies. The index is calculated using a weighted average of the prices of a select group of currencies.

There are several factors that can influence the US Dollar Index, including:

– The strength or weakness of the US economy relative to other economies

– Interest rate differentials between the US and other countries

– Political or economic events that impact global currency markets

– Supply and demand dynamics in global currency markets

Each of these factors can have an impact on the overall value of the US dollar, which in turn can impact the level of the US Dollar Index. As such, traders need to be aware of these factors when monitoring the index for potential trading opportunities.

How can you trade the US Dollar Index?

The US Dollar Index (DXY) is a measure of the value of the United States dollar relative to a basket of six foreign currencies. The index is heavily weighted towards the euro, with a 57.6% weighting, followed by the Japanese yen (13.6%), the British pound (11.9%), the Canadian dollar (9.1%), the Swedish krona (4.2%), and the Swiss franc (3.6%).

The DXY can be traded as a futures contract on some exchanges, or as an ETF or ETN on others. The most popular ETF tracking the DXY is the PowerShares DB USD Index Bullish Fund (NYSE Arca: UUP). This fund tracks the performance of the DXYindex, before fees and expenses, and provides exposure to long-term USD bulls.

Conclusion

In conclusion, the US Dollar Index is an effective and efficient way to measure the strength of the United States dollar against a basket of other major currencies. It provides traders with valuable insights into market sentiment that can be used to make informed trading decisions. With such information at hand, those trading in financial markets can increase their chances of finding profitable opportunities in FX pairs or any other asset classes related to USD performance.