LLC vs. S Corporation

LLC and S Corporation are often discussed together, but they are pretty different. It is vital to know that LLC is a legal business structure and S corporation is a tax classification.

LLC and S corporation are not an either-or choice. Instead, S corporation is an added tax status for any registered business/LLC.

When an LLC chooses to be taxed as an S corporation, LLC’s owners are taxed as the business’s employee. Therefore, the LLC formation services provide a complete guide and facilitation of startup your LLC business. The top-rated LLC services provider by Bizreport gives you the LLC formation service. Yet, it will help you to set up your S corp status.

LLC vs. S Corporation: the Basic Difference

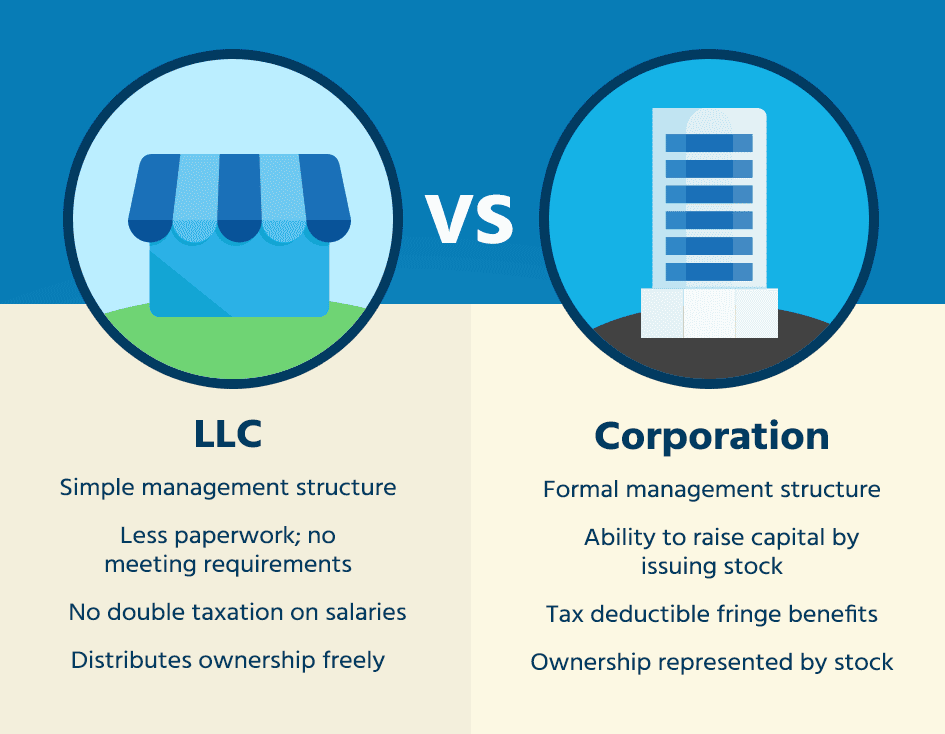

The fundamental difference between the LLC and an S Corporation, as told earlier, is that LLC is a legal business structure that helps the business owner be saved from unnecessary litigation. However, the S corporation is a tax structure that provides liability protection and saves the business to pay corporate and personal tax. Therefore, both LLC and Corporation can apply for S Corp taxation under the Subchapter S of the IRS Internal Revenue Code.

It is right to say that LLC formation is the first step to applying as an S Corporation.

What is an LLC?

A Limited Liability Company is a form of legal business structure that limits the business owner’s liability. It protects the owner’s personal assets from the business debt. LLC is a standard business structure for SMEs and entrepreneurs due to its simplicity and flexibility. LLC owners need to pay self-employment taxes for all income.

The LLC has no restriction on the number of members. Additionally, the owner of LLC may choose the management structure on his own. The owner may act as a manager and run the business operations.

LLCs are taxed differently than corporations. It allows pass-through taxation. For example, when a business incurs a profit or a loss, it passes through the company. Instead, it is recorded into the owner’s personal return. An LLC owned by a single member is taxed as a sole proprietorship. However, an LLC owned by multiple partners is taxed as a partnership. Additionally, LLCs don’t have their own IRS tax category. However, LLC may apply to upgrade their business status as S Corporation by completing some legal requirements. You can check the detail on Bizreport.

What is S Corporation

An S corporation is a tax arrangement that provides a liability guard and passes income through the business owners, typically in dividends, to avoid dual corporate and individual taxation.

Registering as an S corporation helps you to avoid double taxation. However, it puts certain restrictions, i.e. you can not have more than 100 principal shareholders in an S Corp. In addition, the management structure is more rigid than proprietorship and partnership.

Additionally, S Corporation has a more robust existence than LLC and other proprietorship and partnership businesses where the company may be dissolved with the departure of one and other members.

S corporations pass the income, losses, deductions and credits through their shareholders for federal tax perseverance. The pass-through feature helps to cater for the issue of double taxation. It does not allow federal taxation to levy tax on the corporate profits and then again on the shareholders when they receive the dividend.

When to Continue as An LLC?

It is recommended to keep your business as a simple LLC vs. S Corporation when you don’t want to follow strict rules and procedures associated with managing an S Corporation. However, using the facility of avoiding double taxation has certain payoffs.

LLC has simple reporting requirements. It can have an unlimited number of owners, and non-citizens can partially own the business. While choosing LLC vs. S Corporation, you are least concerned with formal business structure and dictating management roles.

When to Continue as S Corporation?

Upgrading your LLC, partnership, or corporation into an S corporation will be worthwhile if you want to scale up your business. S corporation requires additional details on tax forms and payroll systems for a scale-up company. A company that small profits may not need to upgrade as S Corporation.